Germany’s banks ranked by client feedback - can you guess the results?

We’re already at the end of the third quarter of 2021, and the effects of the changes that have shaken up many sectors in the past year can still be felt. Where do banking clients stand in this process? What is it they want most when it comes to handling their finances? We’ve examined unsolicited online feedback for 13 of Germany’s banks to bring you the freshest trends and rankings.

Banking habits have been changing rapidly as digitalization has transformed the sector in the past years. Banks need to watch client feedback closely, to keep their reputation impeccable, and polish their services to level with the intensifying competition. For this blogpost, we have examined the online reputation of Germany’s top banks from the 1st of July to the 30th of September 2021, to get a general view of clients’ expectations and impressions.

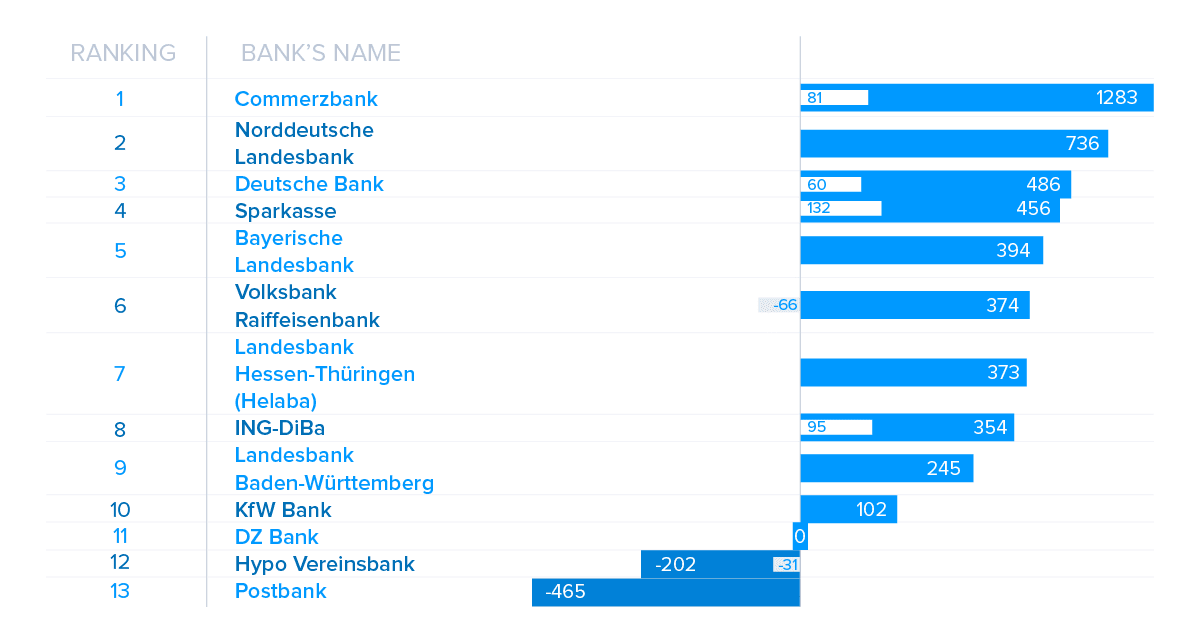

We have created a ranking for the country’s top banks based on our algorithm’s sentiment analysis: we’ve divided the number of their online public mentions for the whole of the examined period with their closing sentiment score. (Our algorithm scores each expression in the texts that has a positive or negative sentiment in it. Then, the values are aggregated, and thus we get an overall score expressing users’ online opinion in any given time frame.)

The results can be seen in the table below. It must be noted that Sparkasse, Commerzbank, and Deutsche Bank had the highest number of mentions out of all 13 banks, so it is impressive that they are in the top 4 as well based on the sentiments in those mentions. Most of the other banks had a positive overall score, too, however, HypoVereinbank’s and Postbank’s clients were dissatisfied with them in the past 3 months.

Blue lines show overall scores, while the second, white lines show app review scores. The latter are only displayed when the given bank has an actively used mobile application.

Blue lines show overall scores, while the second, white lines show app review scores. The latter are only displayed when the given bank has an actively used mobile application.

Does having great app reviews lead to high overall satisfaction?

Since digital solutions play such an important part in today’s banking culture, we have separately examined the reviews users left on the banks’ mobile applications. We wanted to see whether banks that users were generally satisfied with also had popular apps on hand.

Only six of the thirteen banks had widely reviewed applications (two more had a few reviews but not enough for a just comparison). Again, Sparkasse, Commerzbank and Deutsche Bank must be mentioned, along with ING-DiBa this time: just like we’ve seen with the general opinions, their users were highly satisfied with their apps as well. On the other hand, Volksbank Raiffeisenbank and HypoVereinsbank had rather disappointed application reviews.

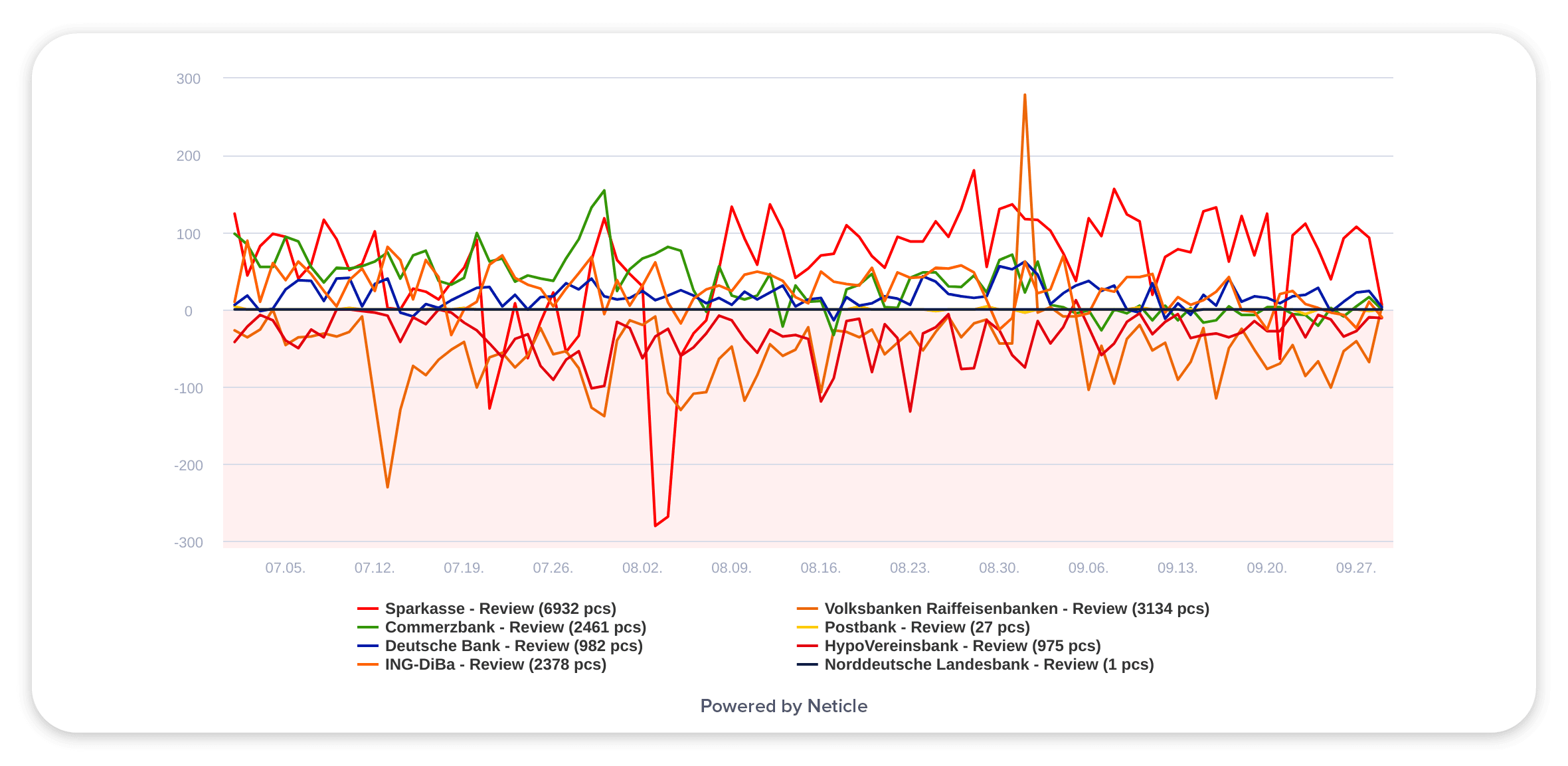

Daily satisfaction levels in the banks’ app reviews – one good day was not enough to save V. Raiffeisenbank

Daily satisfaction levels in the banks’ app reviews – one good day was not enough to save V. Raiffeisenbank

So, while there may not be a direct causal link between overall satisfaction and satisfaction with applications (in other words, it takes more than a good app to make clients happy), it is clear that banks clients are satisfied with also have widely used apps with highly positive reviews. Banks at the bottom of the ranking either did not have applications or their apps were rather disappointing for clients.

What else leads to satisfaction?

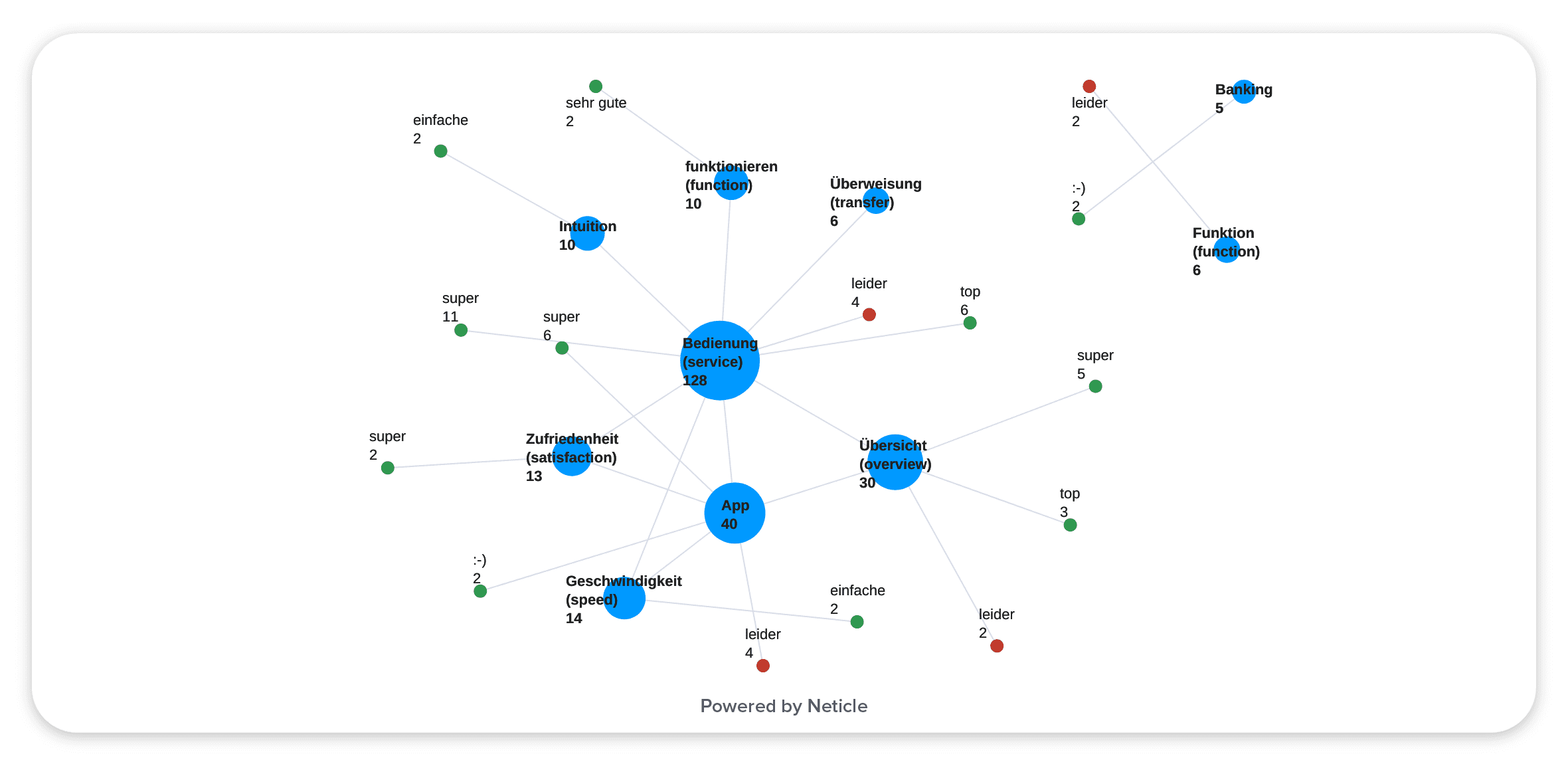

After analyzing the general feedback in all 13 banks’ mentions, a few factors stand out that nearly all clients pointed out as key attributes in their feedback and expectations. The more “traditional” ones were price, speed, and smooth transfers. These showed up in both the positive and negative feedback, so clients made it equally clear when they were satisfied with them and when they had problems.

Many clients highlighted private banking services as important instead, and good offers and strategy also appeared among the expectations. Perhaps a bit more surprising, yet a very common attribute clients expected from banks was sustainability: it appeared among key attributes for half of the banks on our list!

There is another trend that shows how times are changing: customer service almost didn’t make it to the toplists at all (it only appeared on Postbank’s key attribute list). At the same time, application and modernity were often key topics/attributes.

A snippet from Commerzbank’s feedback: this is what customers think of when they talk about the bank’s services

A snippet from Commerzbank’s feedback: this is what customers think of when they talk about the bank’s services

In short: if you’re a stakeholder at a bank in Germany looking to improve client satisfaction, put application development and sustainable actions on your hotlist now!

Do you also want to see how your brand ranks compared to others? Run a social listening analysis today!

Share: