Global giants put to the test: how Apple, Microsoft & Samsung compare

Does the online opinion of users reflect the international value of a brand? Can local marketers lean back if their brand is popular overall? We’ve got these questions answered using the power of social listening.

Brand Finance has recently released its Global 500 report for 2023, which lists the most valuable and strongest brands across the globe. The list contains brands from various sectors, but players from the field of technology are quite numerous at the top.

To discover if the local online reputation of some of the toplisters reflects their position on Brand Finance’s list, we have chosen Apple (#2), Microsoft (#4) and Samsung (#6) from the technology sector and used Neticle Media Intelligence to collect and analyze their public online mentions from Hungary from 2022.

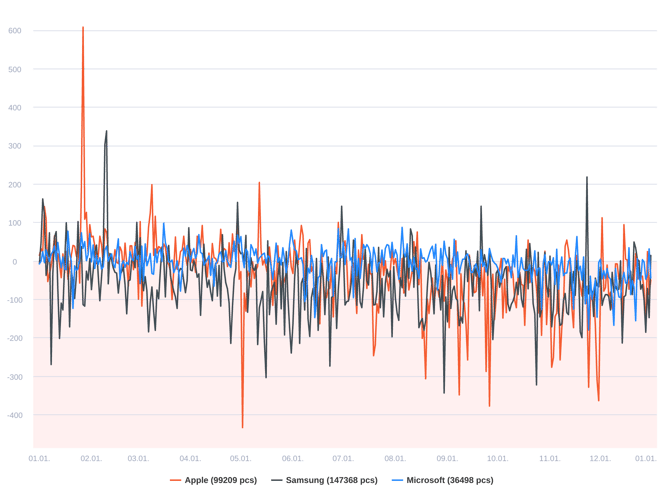

The most talked about brand out of the three in Hungary by far was Samsung, with four times as many mentions as Microsoft. When we examine the polarity of those mentions, the daily Web Opinion Index (Neticle’s own indicator that aggregates the results of the algorithm’s sentiment analysis) shows that Samsung had quite a few downtrending periods regarding its reputation, though Apple's dipped into bigger extremes.

The daily Web Opinion Index pinpoints days where users had more complaints than positive feedback

The daily Web Opinion Index pinpoints days where users had more complaints than positive feedback

All three companies have room for improvement when it comes to their local online reputation, though Microsoft managed to stay in the positive zone for most of the year. Let’s see what topics were discussed concerning each of them, to get a better understanding of what caused disappointment and what made users happy.

The most common labels attributed to the mentions can be seen in the treemap below. Users mentioned Samsung in connection to its phones the most, especially the Galaxy models. For Apple, phones were also the most important topic, with iPhones being the number one label of course. Microsoft was most associated with Windows, but different games also frequently came up.

.png?width=1876&height=952&name=Tech%20sector-label_treemap-2023-02-02%20(1).png)

Top labels in proportion to their mention numbers

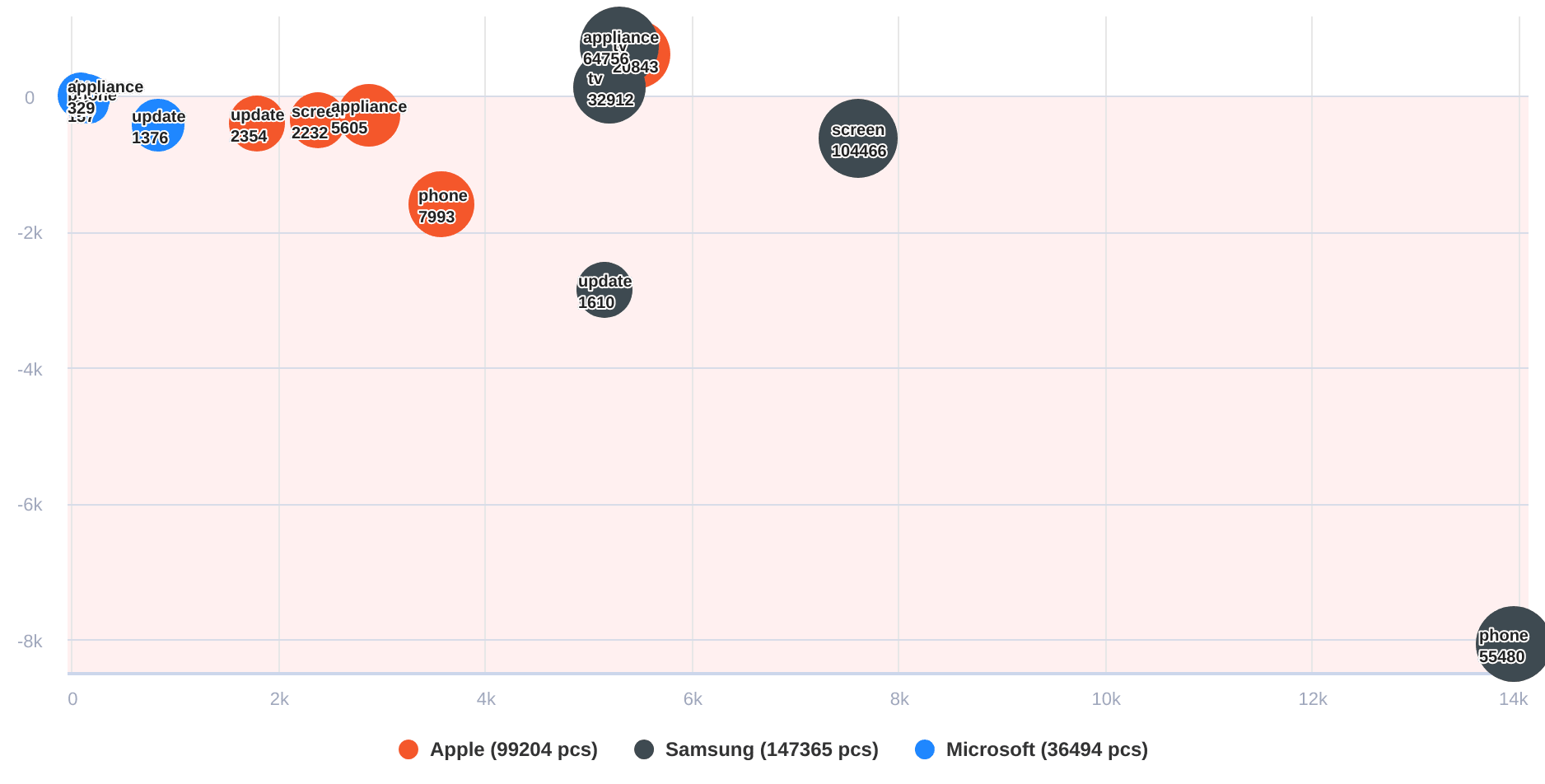

The topic map illustrates how the same topics for the different brands had opposite polarities based on what users thought and said about them online. While ‘phone’ is very negative for Samsung, it’s not as bad (though still in the negative zone) for Apple. Appliances and updates roughly have the same reputation, the difference is rather in the mention numbers, while ‘tv’ is positive for both Apple and Samsung (though in one case it’s a streaming service, while for the other, it’s a device).

The topic map shows online opinions (Y axis) and mention numbers (X axis) together - the numbers in circles show online interactions

The topic map shows online opinions (Y axis) and mention numbers (X axis) together - the numbers in circles show online interactions

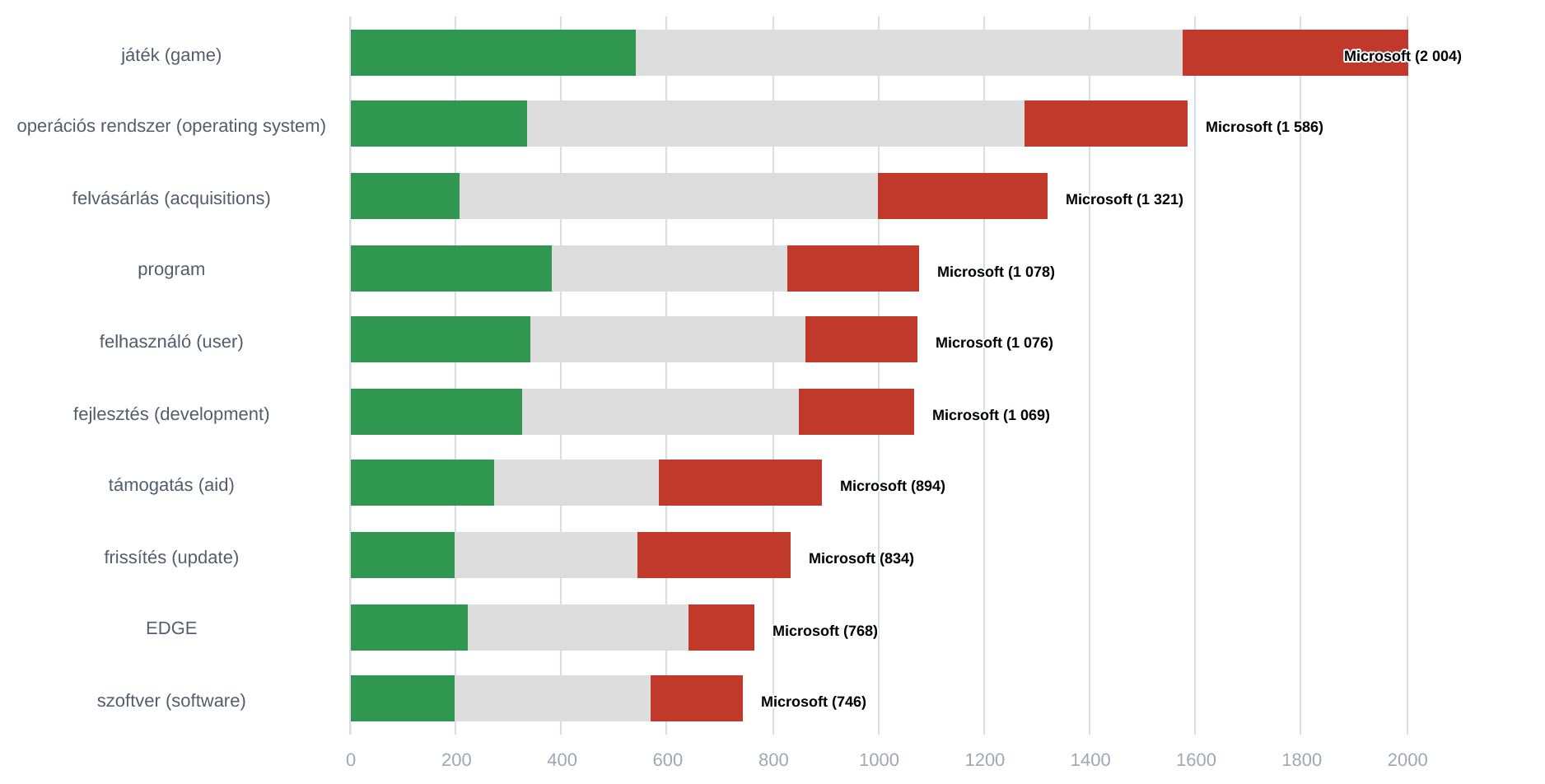

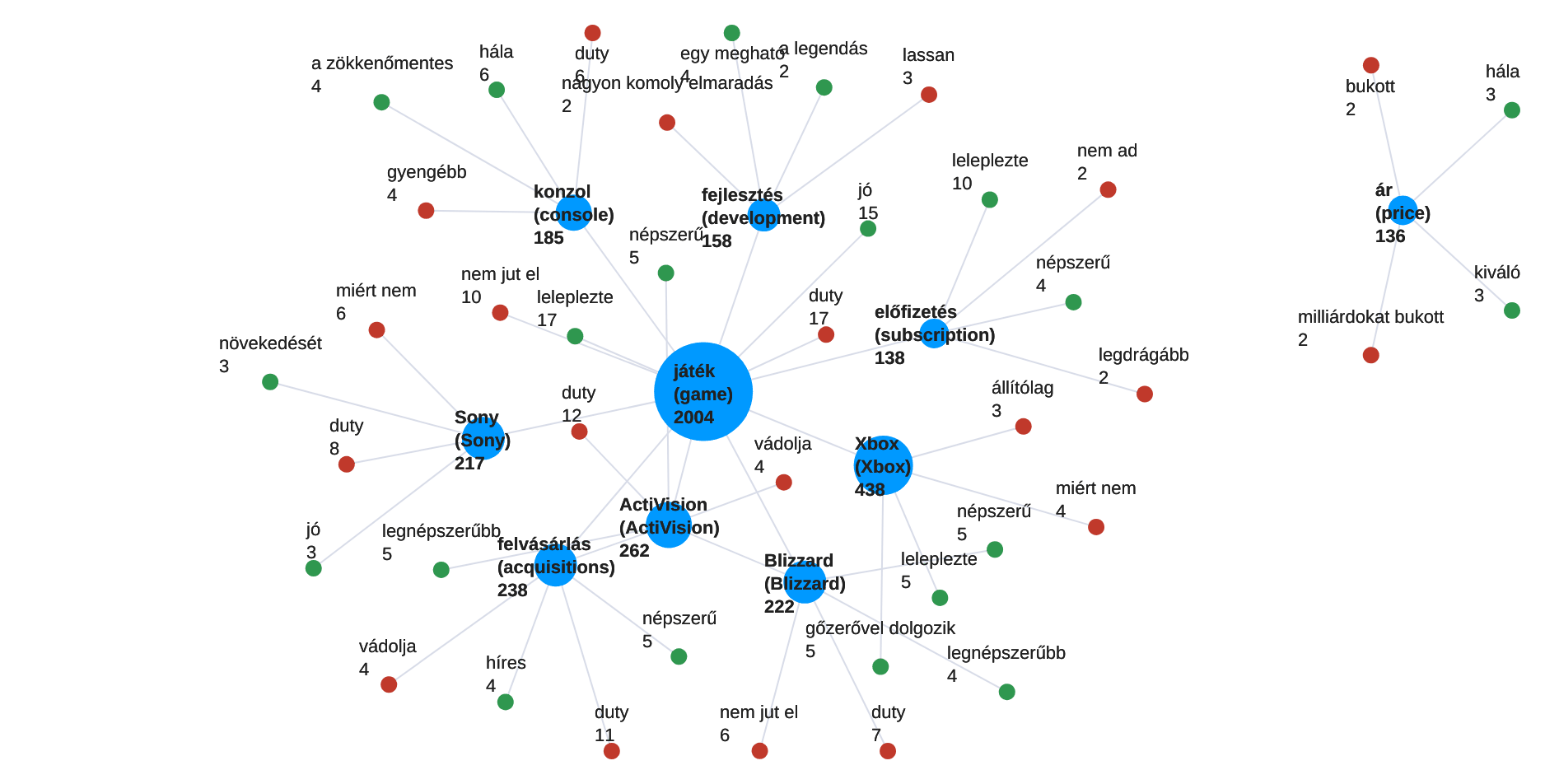

For Microsoft, the conversation revolved around slightly different topics, as we have partially already seen so far. The key topics chart shows it even better. A hot topic for Hungarian users in connection with Microsoft was games, in part because of the games they could download from the Microsoft store, but also because at the end of the year, it got huge media coverage that Microsoft was to acquire Activision Blizzard.

This had many possible implications for different games and consoles, as can be seen in the mention graph below.

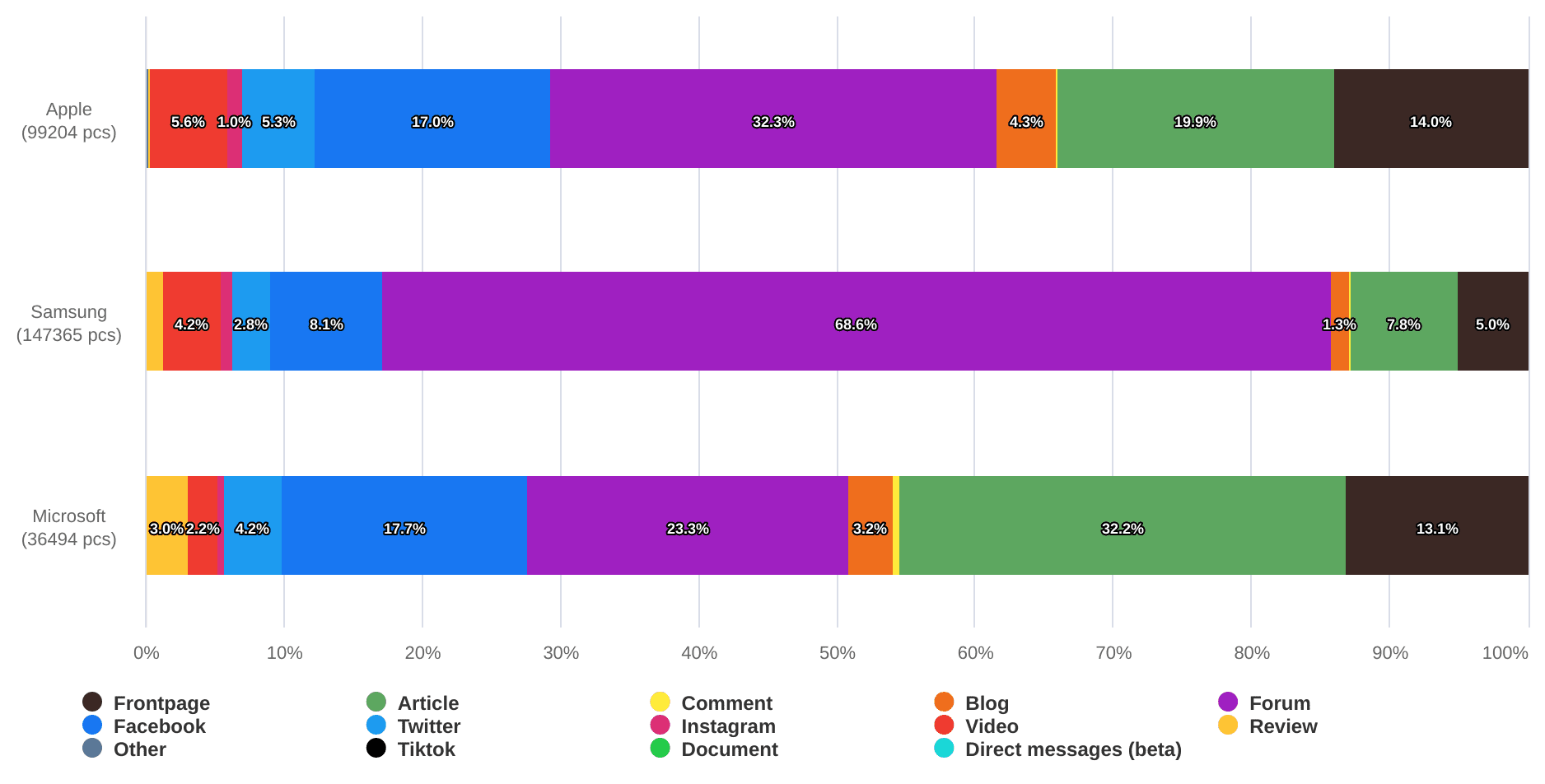

An interesting aspect to compare is which platforms played important roles in discussing the three brands. Here, Apple and Microsoft are rather similar: the most significant portion was articles in online media, while forums and blogs contribute around a third of the mentions. The role of Facebook and Twitter is smaller compared to these, but still significant. Samsung’s mentions, on the other hand, came largely from forum discussions, and all else mattered much less.

The share of platforms in social media and news

There’s a lot more that we could uncover using Neticle Media Intelligence, but it’s already evident that local opinions vary widely, and it’s important to pay attention to what users are loving and complaining about in their context. Their views can be influenced by loads of factors, so to target them with the best campaigns and to use the best channels, marketing and sales professionals need to keenly follow local online reputations.

Try it - you could be surprised what users are saying about your brand!

Share: