Social listening reveals the subtle and unexpected details, too

Péter Katona has been an Analyst at Neticle for close to five years and has worked on a wide variety of topics for clients across the finance, retail, and telecommunication sectors. In this interview, he shares his best tips and tricks to creating an insightful analysis, and tells us about the lesser known but advantageous ways in which social listening can benefit you that you probably haven’t heard about.

You have been working with Neticle Media Intelligence for years to help clients understand their online reputation. How do you see social listening’s benefits, and which ones do you find to be less obvious, but still important?

User created content found by social listening is never triggered – and therefore, never influenced – by prompts or questions, unlike in a survey or an interview. This means you get unfiltered, honest results. I often find that with social listening, very particular, surprising, and profound details come to the surface that clients, researchers, or developers absolutely didn’t and couldn’t anticipate. On another note, I find the analysis of platform specific brand communication to be very valuable, as it serves as a great input for campaigns in multiple industries.

Social listening also provides real time feedback, and makes continuous tracking possible, so your data becomes very easily comparable month by month. However, being real time also means that you can get alerts immediately whenever something unexpected or crucial happens, while other research methods only provide retrospective understanding, but offer you no chance to react immediately.

All research methods have their advantages and can work together, informing and strengthening each other. One of my favorite ways to use social listening is to apply it as a discovery method, and then use its outputs for more focused CX research.

In your experience, how much do clients know about these advantages when starting to work with Neticle?

This varies a lot. When they approach it with a “let’s see if this will work for us” or a “just trying to cover all grounds” attitude, it is our job to help them get the most out of this method and highlight key insights.

When they’re a little more experienced, because they’ve used other social listening tools, for example, they usually turn to us with more specific questions, or they already know which competitors they want to track.

Tracking competitors is another super important benefit to social listening because you’ll discover the industry benchmarks for the online space. We always suggest keeping an eye on the other players in the field!

I’m saying this because it’s much less expensive to learn from others’ mistakes than your own. With Media Intelligence, you can learn what kinds of discounts, services, and app developments your competitors offer in banking, for example, or if other insurance companies have new types of insurances and whether they’re popular, or if different retailers have introduced new features to enhance shopping experience and how it’s working out for them – the list is endless.

Typical things that I’ve seen clients be surprised by is that we can tell them about the lifecycle of a piece of news, how quickly a crisis passes and how, the reach of and reactions to their posts, or how different sources/hubs develop in relation to a brand.

I already have a pretty solid idea of different sectors and their needs, so I always try to support clients with ideas on what to look out for and demonstrate what we can help them with.

Neticle Media Intelligence offers over a hundred charts, which can be a bit overwhelming at first. Tell us about some of your favorite ones to use!

I understand where this is coming from – finding the balance between easy to understand and detailed can sometimes be a challenge.

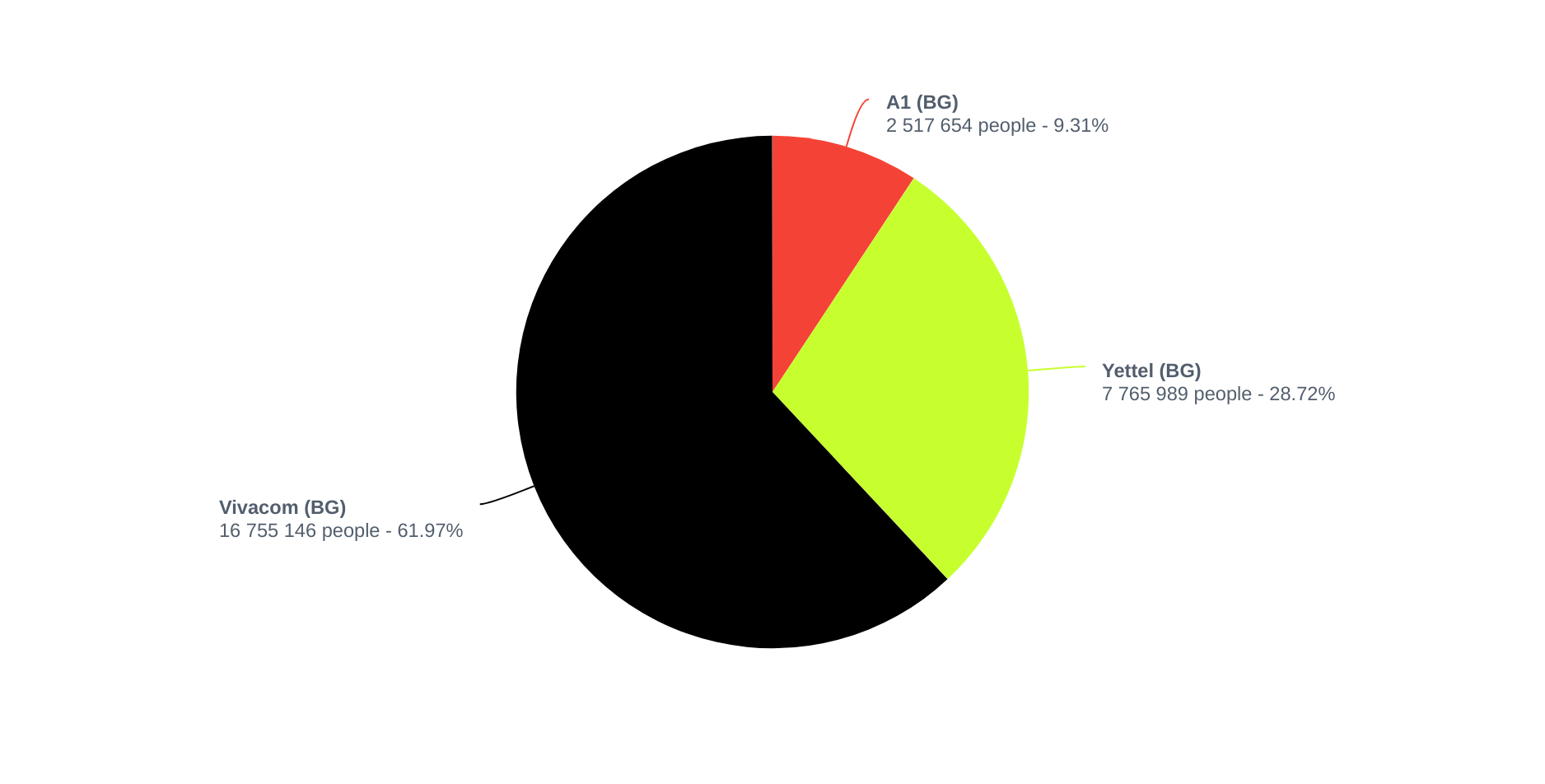

One thing I love is putting the aggregated reach of companies’ online press mentions on a pie chart, together with competitors. This will tell you in an instant how much share your company and others have had in online news in any given time period. I want to highlight this because we frequently get questions like “we publish a lot of PR articles, but we’re not exactly sure where they appear and what their effect/reach is”. This is something we can answer very easily! It might turn out that some companies generate more reach with less articles, if those appear on more relevant sites.

PR activity in general can be tracked very well: pair online news tracking with watching engaging topics on social media – the two together reveal a ton! I also like analyzing social media performance rates by platform for each competitor, this helps a lot when putting together a strategy for different age groups. It will answer questions like what platform to use for each type of campaign, or if you should start cooperating with influencers or not. The last thing you want is to have a TikTok channel where Gen Z users are disappointed by content geared at Millennials or boomers.

Neticle has its own proprietary Web Opinion Index, which is a key indicator for many clients. Can you explain its significance?

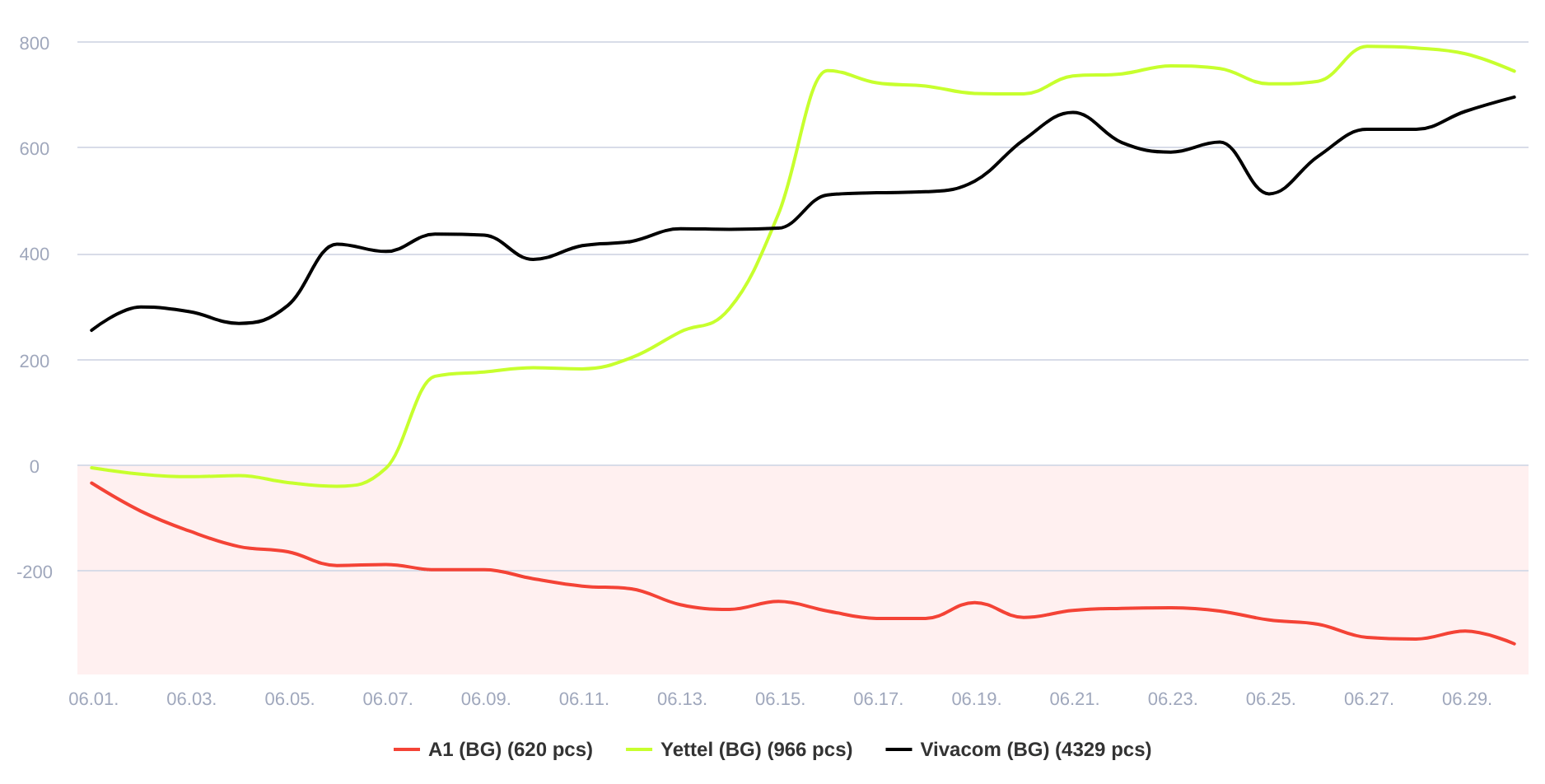

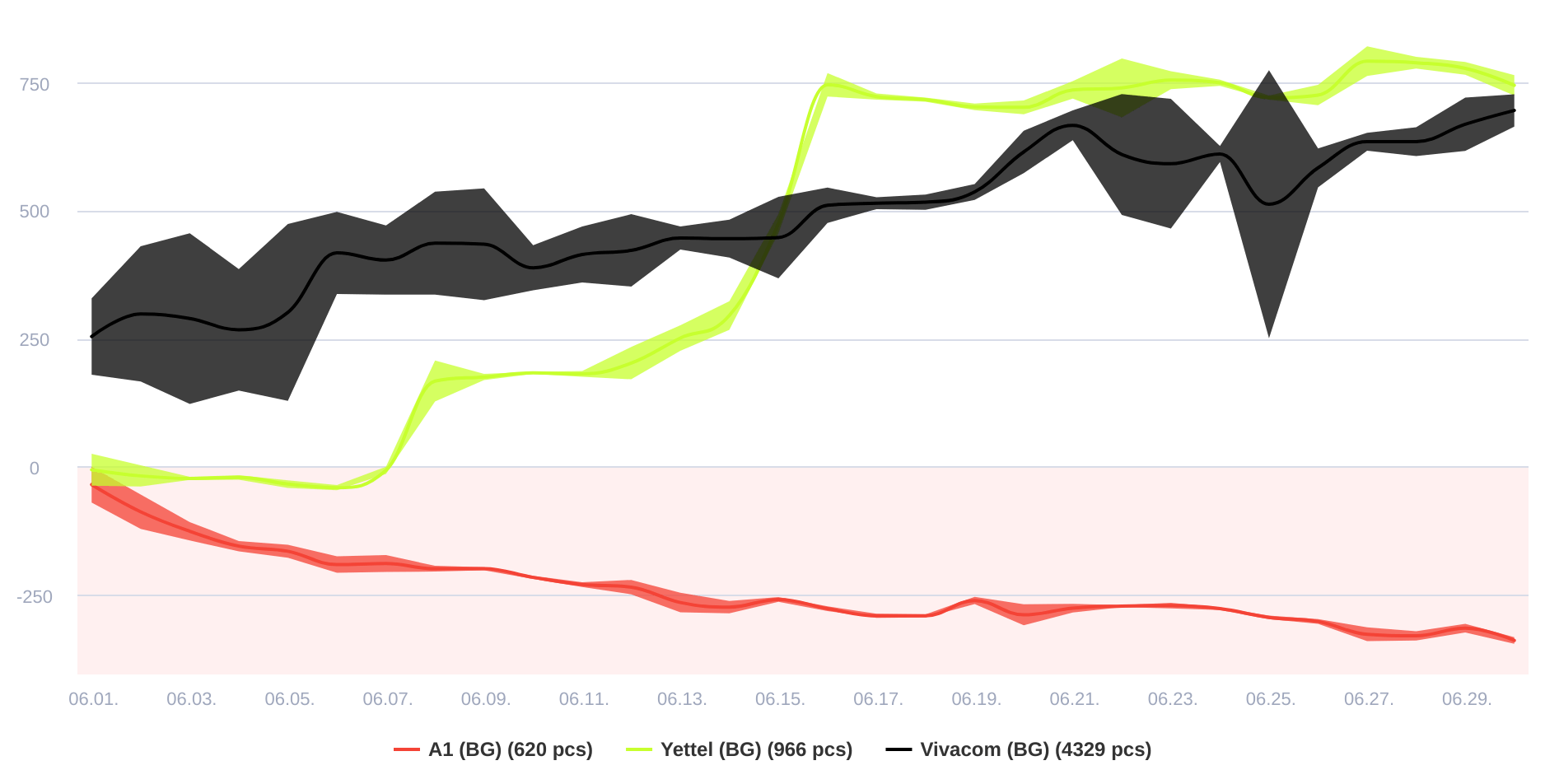

The Web Opinion Index (WOI) chart works just like an index in the stock market. Neticle’s system automatically performs sentiment analysis on the collected mentions, and scores them based on the polarity and strength of the sentiments found in them. These scores are then aggregated from the starting point of the time series. If on any given day, the sum of the scores is negative, the graph will move down just like in the stock market when stocks lose value.

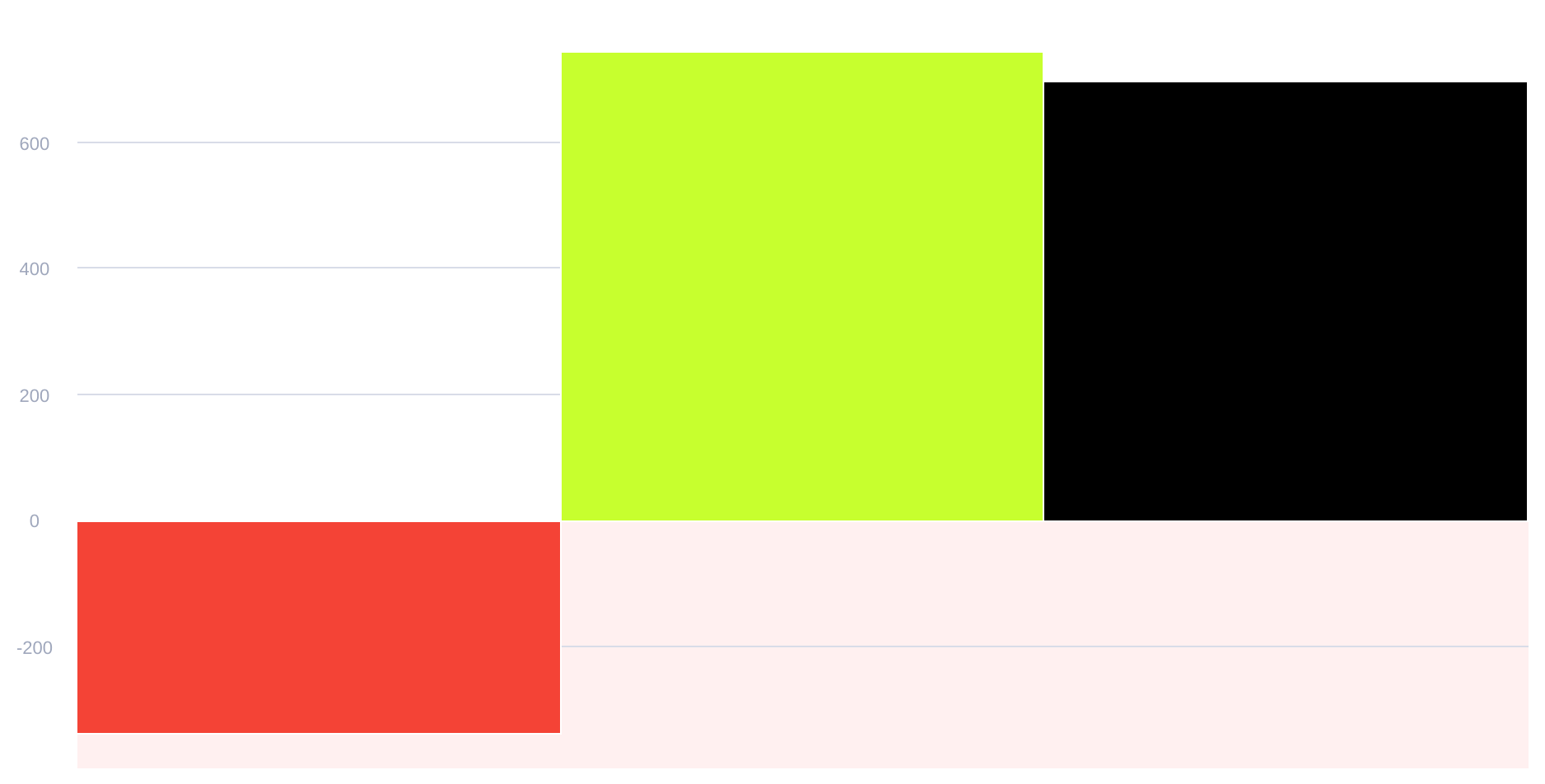

We also have a Closing Web Opinion Index chart, which displays the final sum in any given period, however, the time series version matters a lot, because while two companies might have very similar closing WOIs in a month, they often take completely different routes there: one with big ups and downs, and the other a more stable one. In the stock market, it also matters how steady a rate is: if it fluctuates a lot, it creates problems. So, the Web Opinion Index is useful when you’re watching your competitors, but the closing WOI can also be used as a benchmark.

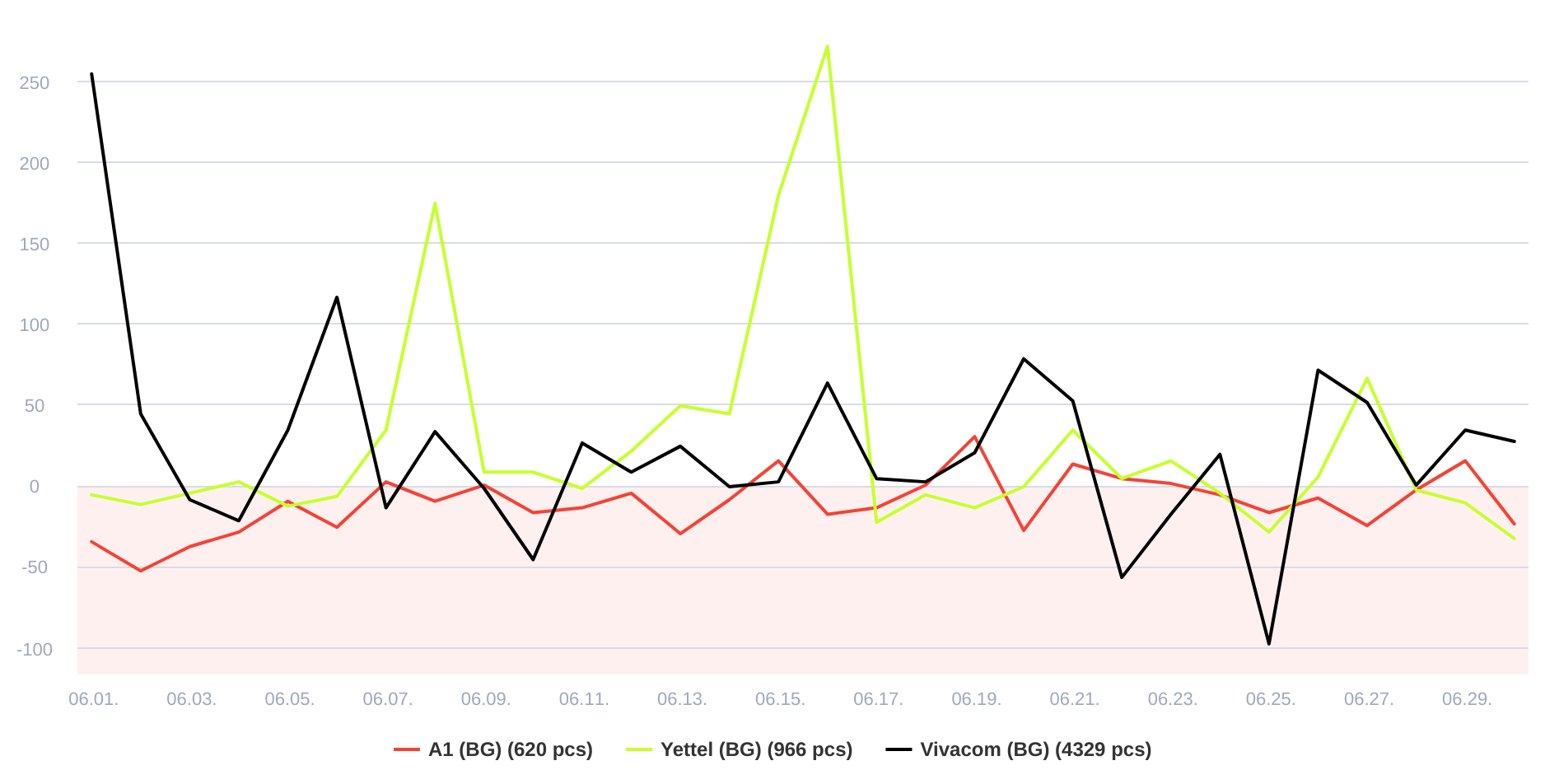

Don’t confuse these with the Daily Web Opinion Index chart, which aggregates scores for mentions on a daily basis. This is rather helpful to identify events, like peaks or outbreaks for a keyword.

I like to check the Number of Mentions chart too, though, to understand how much content was behind a peak, or the Mention Flow chart, which shows the default Web Opinion Index and the volume of mentions at the same time.

In a social listening analysis, there are several online hubs that you can extract insights from. Which ones should we pay attention to and why?

I love forum content: this is where the most profound details come to the surface, because topic experts still very much use them to discuss any minuscule development of their fields. This is especially true in the technology, fintech, telecommunication and banking segments. The age groups behind these are not as obvious as with the main social media platforms, but the content posted here is highly valuable. However, if your topic of interest is politics and public affairs, forget forums: Facebook is your platform to watch.

When it comes to online hubs, it’s also interesting to track how news spread from one platform to the other. Sometimes you’d think that a certain topic will become the center of attention, but the news competition is intense, so it’s easy to get overshadowed. At least with social listening, you’ll know exactly what has happened.

Finally, tell us about how you see the future of social listening!

It depends on the company and the market of course, but I think that data integration and automatization are becoming more important and will continue to. It is hard to avoid the topic of AI as well, of course – I certainly think that AI will play a bigger part in the future, but I’m certain that it will be best combined with human intelligence, just to take care of the more repetitive tasks. I’m looking forward to it, because it means that analysts will have more room to be creative!

Share: