The fintech revolution creates intense competition

One of the most useful ways you can benefit from social listening is competitor analysis. Let’s see how that works through examples from neobanks in the Nordic region!

Today’s online world is overly saturated with advertisements and campaigns, so the competition for the attention of potential customers can be fierce. There is a lot to consider when choosing your topics and messages, because you don’t want it to be a copy of one of your competitors, but at the same time it’s beneficial to join the conversation when there is a hot topic that concerns your line of business.

Going in an entirely new direction is also possible, but to do that, it’s still useful to know what has recently been discussed and what approach was taken. Keeping an eye on your competitors’ content is also helpful because in case they make mistakes, you can learn from them and not fall into the same trap.

So, how do you do all that? Social listening tools were created exactly for this purpose. Neticle Media Intelligence collects all public mentions of any given brand – in this case, you and your competitors – from the web, separately for each country. Then, using its built-in NLP engine, it automatically analyzes all the collected text, showing hot topics, active pages, engagement surges, prevailing emotions and much more.

How are the Nordic region’s favorite neobanks performing in the online world?

Finland, Denmark and Sweden all have a neobank headquartered there, along with approximately a dozen other neobanks offering their services. No neobank is headquartered in Norway, but a lot of the well-known providers are available there.

To compare performances in the last three months, we have selected perhaps the most well-known neobank, Revolut, the countries’ own neobanks, plus Wise in Norway, since there’s no Norwegian provider to examine. Finland’s neobank is called Holvi, the Danish have Lunar and Rocker is the one founded in Sweden.

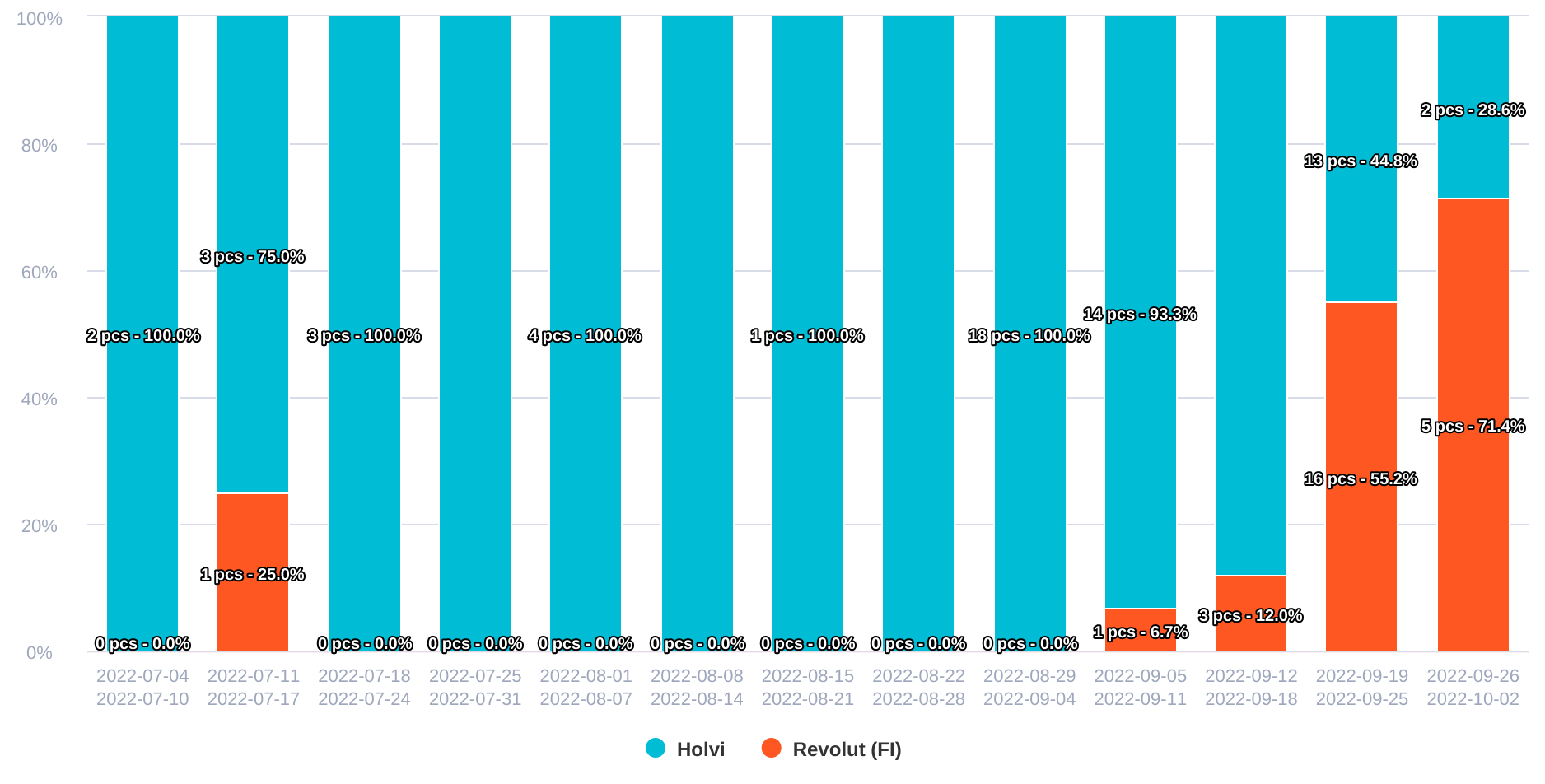

- Who was in the lead each week?

.png?width=1876&name=neobanks-freq_dist_weekly-2022-09-29%20(3).png)

.png?width=1876&name=neobanks-freq_dist_weekly-2022-09-29%20(2).png)

.png?width=1876&name=neobanks-freq_dist_weekly-2022-09-29%20(1).png)

The weekly share of mentions charts show that the competition between Revolut and the local alternatives was most intense in Sweden and Denmark, with significant changes week to week. In Finland, Holvi definitely won, and Norwegians talked more about Revolut than Wise.

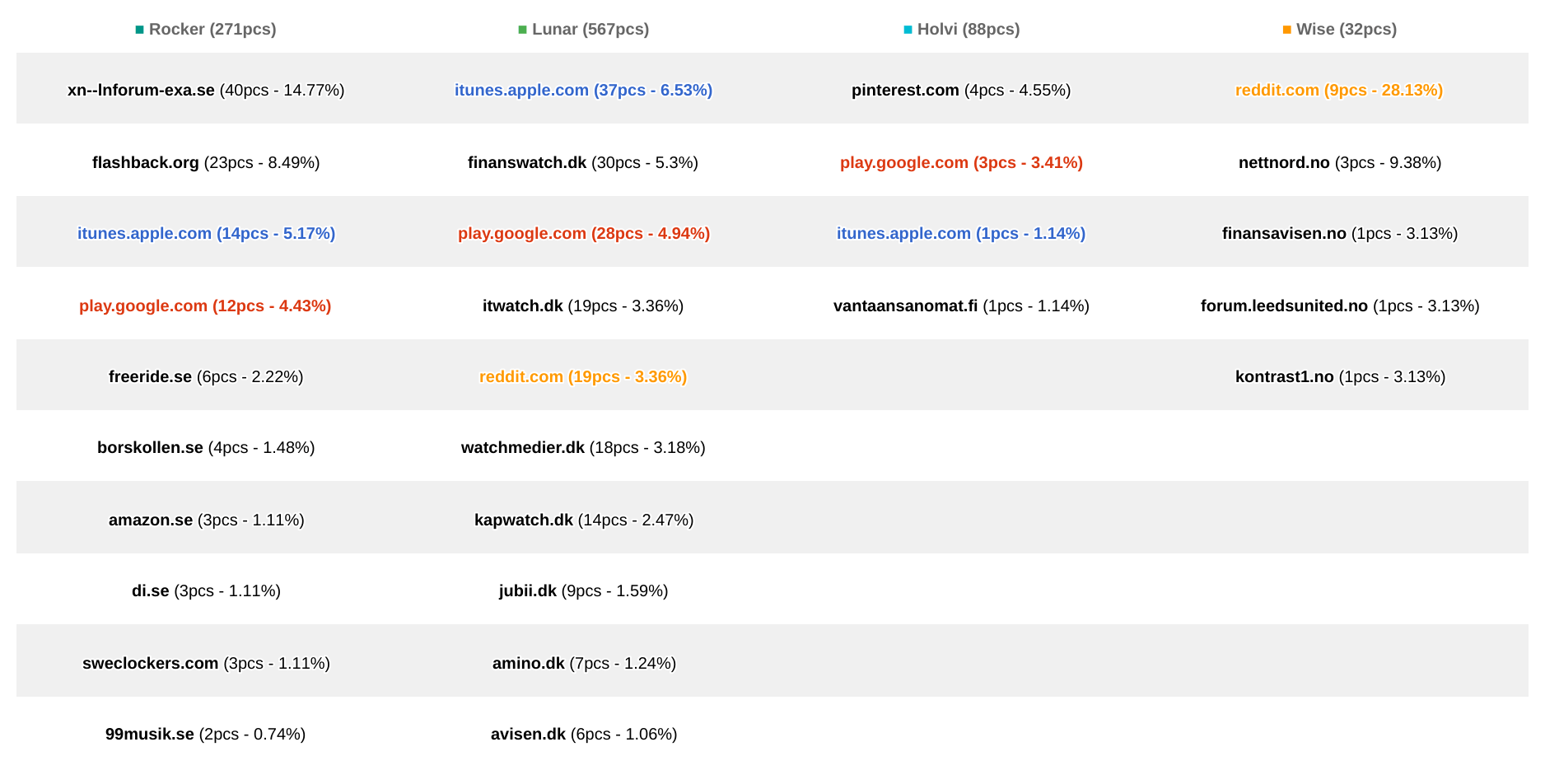

- Which were the top websites mentioning the brands?

.png?width=1876&name=neobanks-pages_heatmap-2022-09-29%20(2).png)

Comparing the websites talking about these neobanks, it’s clear that finanswatch.dk and flashback.org were important for both Revolut and local providers, but there was also a lot of variety and overall, not much overlap between the sites talking about these digital banks. This might be good for them on the one hand, but it means that there are also a lot of spaces where they can still overtake the competition.

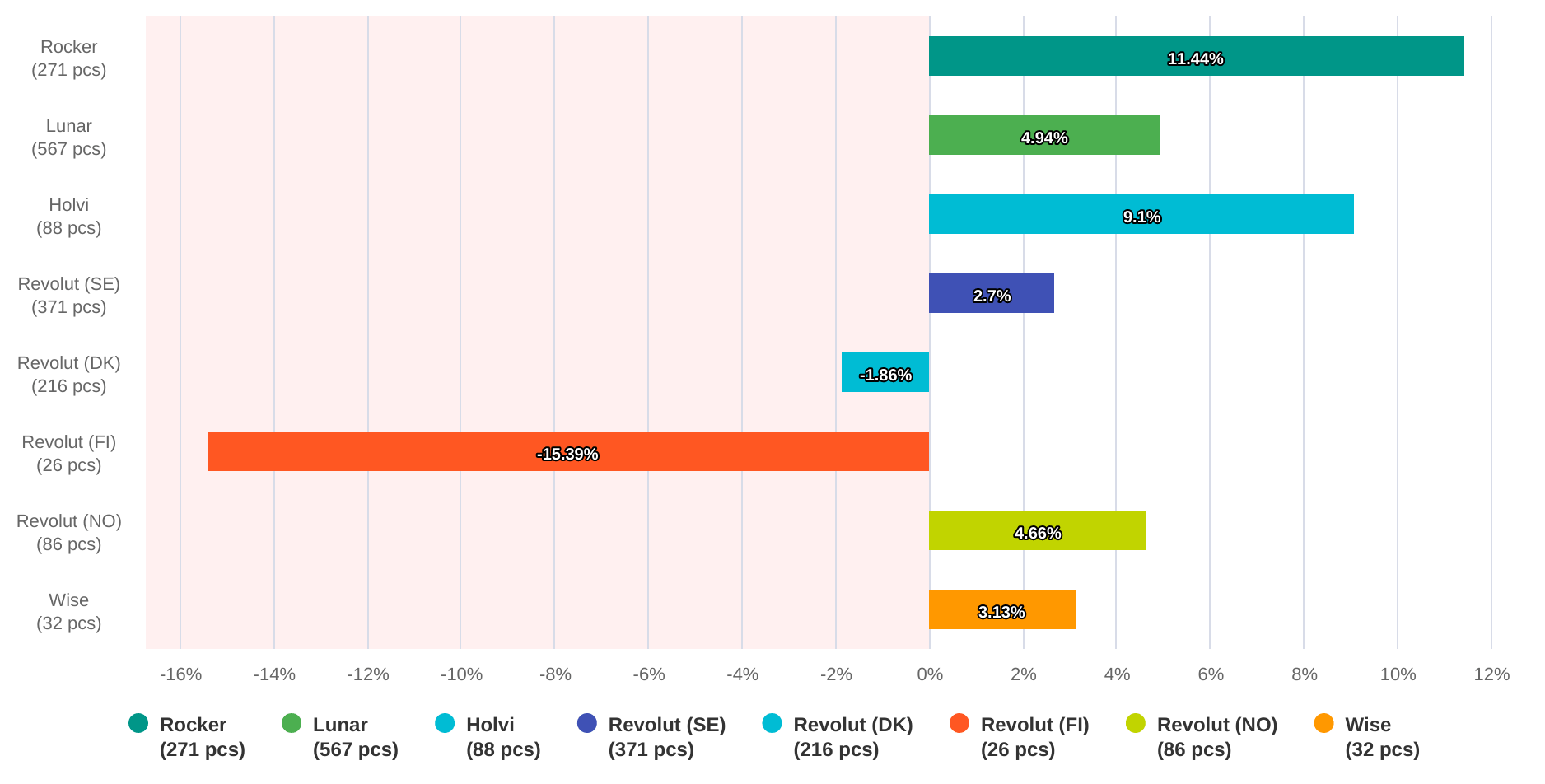

- How did users feel about the brands overall?

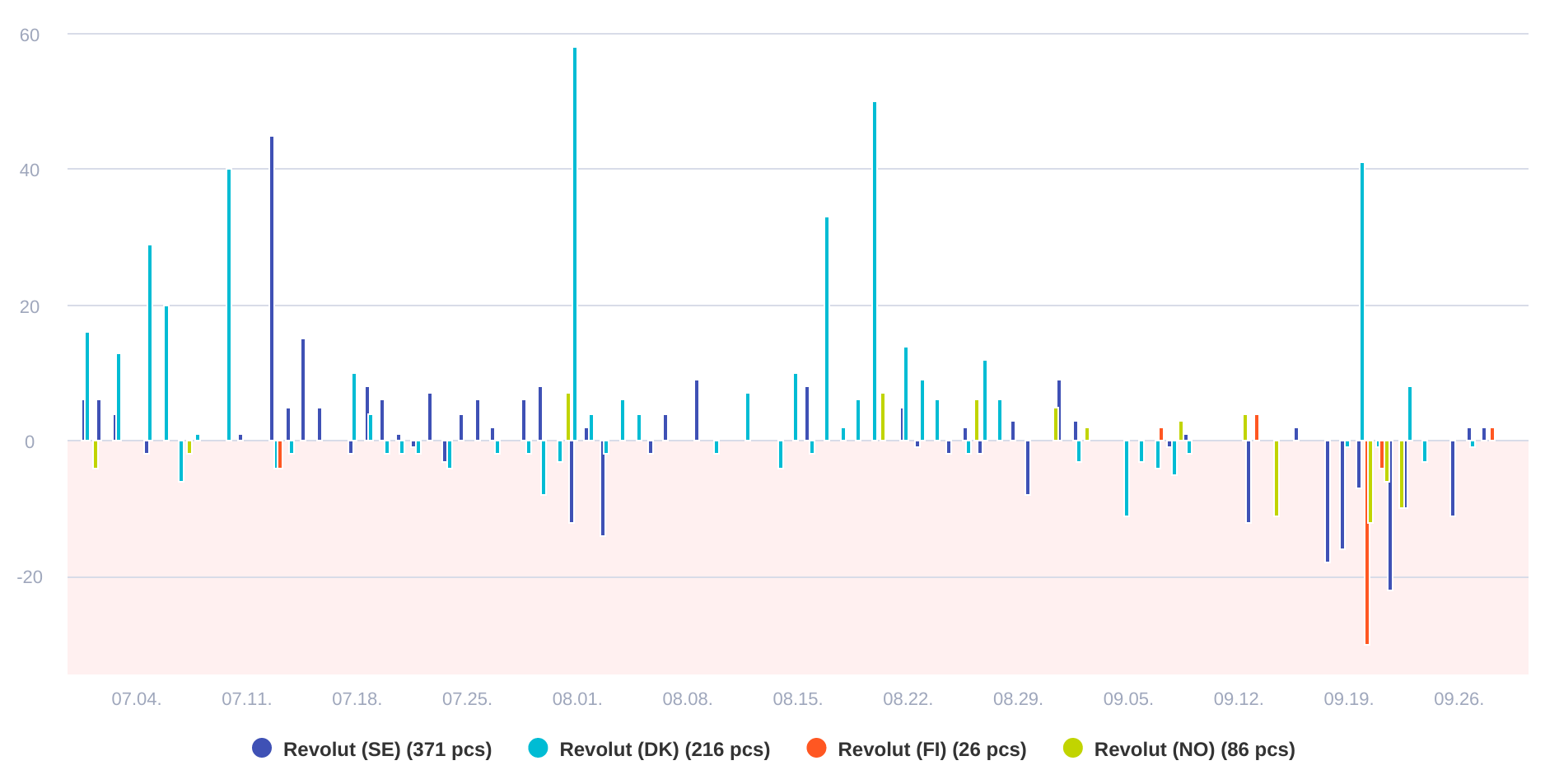

The Net Sentiment Score is calculated by subtracting the percentage of negative online mentions from the percentage of positive online mentions for each brand. It is clear that even though users talked a lot about Revolut, they weren’t satisfied with it, especially in Finland, Denmark and Sweden. However, the local alternatives did very well everywhere and had high Net Sentiment Scores.

The daily Web Opinion Index also reveals that Revolut’s online perception took a negative direction only in September: that is because at the end of the month, lots of news sites reported that hackers accessed the accounts of over 50,000 Revolut clients.

The drop in the polarity of Revolut’s online perception also tells us that cybersecurity is definitely an issue which neobanks need to address and stay on top of, if they want to get ahead of their competition.

There is a lot more you can discover with social listening. It can list the most engaging content for you: the posts that users interacted with the most both on your side and on your competitors’s pages. You can find important influencers or opinion leaders as well, suitable for future PR-partnerships, and you can set up KPIs and industry benchmarks too, so you always know how your results measure up. All of this makes your marketing activity super solid and data-driven.

Want to learn more about how to compare brands with social listening? Click here!

Share: